Comparing savings opportunities with updated Erie auto insurance quotes

To optimize your expenses, consistently review new offers on vehicle protection plans. Recent evaluations indicate that significant reductions can be achieved by frequently comparing current rates from various providers, including Erie. This proactive approach not only enhances your understanding of available choices but can also translate into tangible financial benefits.

It’s advisable to request personalized estimates that reflect your driving profile, vehicle type, and specific needs. Gathering quotes based on these parameters ensures that you receive the most accurate pricing. Additionally, examine any available discounts, such as those related to safe driving habits or bundling multiple policies.

Consider the influence of local factors on your premiums. Rural areas often experience lower rates due to reduced traffic, while urban regions may incur higher fees. Aligning your coverage selection with your geographical circumstances can further enhance cost efficiency, enabling you to select a plan that best fits your circumstances without compromising necessary protection.

How to Compare Erie Auto Insurance Quotes for Maximum Savings

Gather quotes from multiple providers to gauge the variance in pricing. Use online comparison tools that allow you to input your specific information, including vehicle details and driving record. This will ensure a side-by-side view of options available to you.

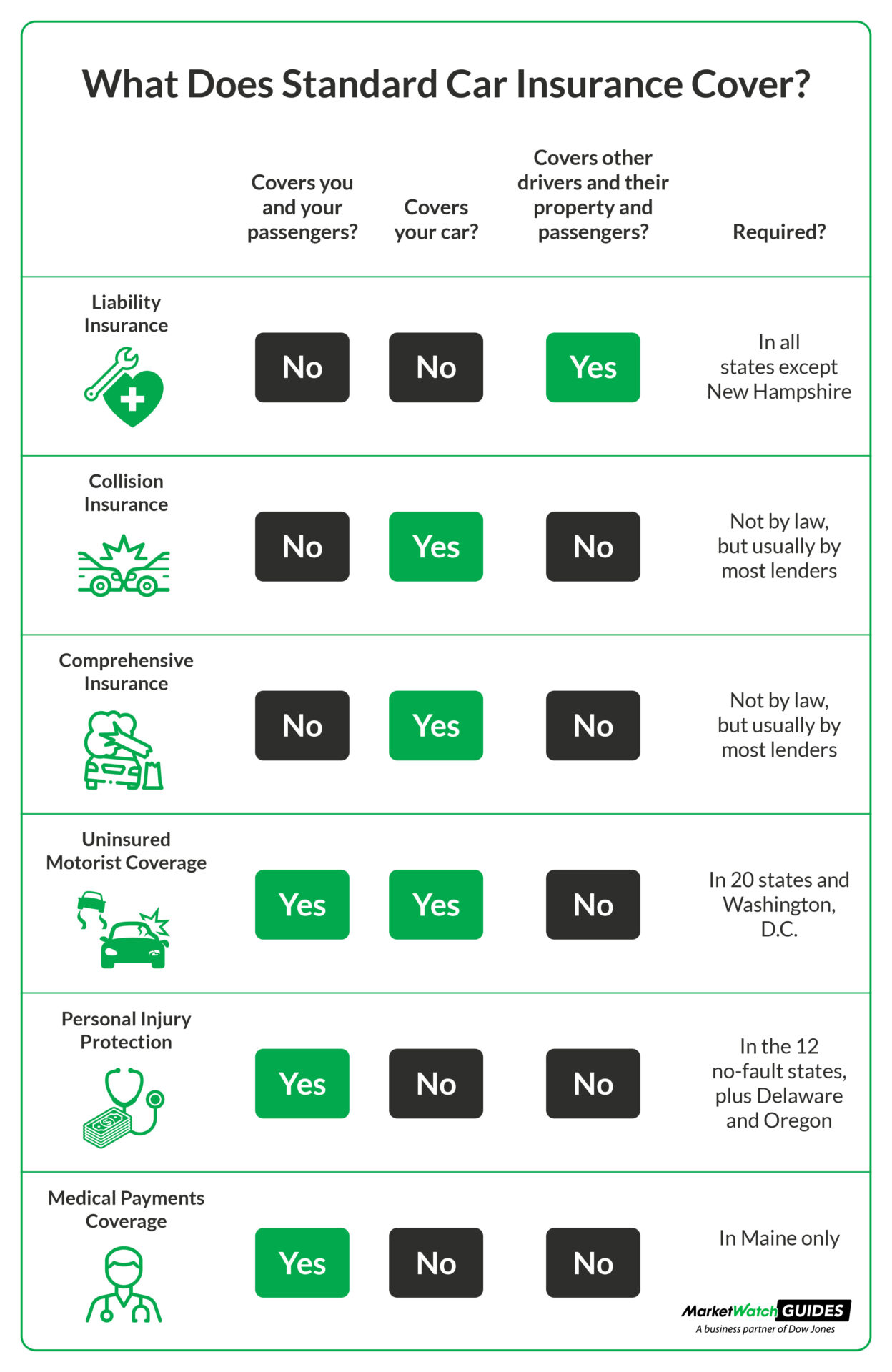

Review policy coverage levels closely. Lower premiums might mean reduced coverage. Determine necessary protection based on your situation, such as liability, comprehensive, and collision coverage. Tailor options to your needs without sacrificing critical coverage.

Analyze Discounts Offered

Investigate potential discounts among different plans. Many providers offer reduced rates for safe driving, multiple policies, or good student achievements. Inquire about available discounts thoroughly, as these can significantly lower overall costs.

Examine Customer Reviews

Evaluate feedback from existing customers to assess service quality and reliability. Reliable claims handling is paramount. Prioritize providers known for prompt and fair claims processing to avoid complications in emergencies.

Key Factors Influencing Erie Auto Insurance Premiums in 2023

Driving history is a primary determinant impacting premium rates. Individuals with a clean record often benefit from lower costs, while those with traffic violations or accidents tend to see hikes. Regularly checking your driving record can help identify areas for improvement.

Vehicle type also plays a significant role. High-performance models or luxury brands typically incur higher premiums due to increased repair costs. Opting for a safer, more economical vehicle can lead to better rates. Researching vehicle safety ratings can provide useful insights.

Your location significantly affects pricing. Areas with higher crime rates or accident frequencies generally result in elevated costs. Evaluate local statistics to understand how your residential area influences your rates.

Age and experience are critical components. Younger, less experienced drivers are often viewed as higher risk, leading to increased premiums. Gaining experience through safe driving practices can gradually reduce costs.

Credit history is frequently assessed during the underwriting process. A strong credit score often translates to lower premium rates, whereas poor credit can push costs upward. Monitoring and improving your credit score can positively impact insurance expenses.

Discounts offered can lead to substantial reductions. Look for multi-policy discounts or benefits for safe driving and low mileage. Ensuring all available discounts are applied can enhance affordability.

For detailed quotes and to gauge individual options, refer to https://erie-insurance.net/.

FAQ:

How can I assess my savings using updated Erie auto insurance quotes?

To assess your savings with updated Erie auto insurance quotes, first gather current quotes from Erie for your specific vehicle and coverage needs. Compare these quotes to previous estimates or competitors’ offers. Look for reductions in premiums, discounts for safe driving, bundling policies, or any adjustments in coverage types that might enhance your savings. Taking notes on these comparisons will help in determining potential savings.

What factors influence the quotes I receive from Erie auto insurance?

Quotes from Erie auto insurance are influenced by multiple factors, including your driving record, the type of vehicle you drive, your location, and the level of coverage you desire. Additionally, factors such as your age, marital status, and even credit history may play a role in the premium calculation. Understanding these factors can help you make informed decisions when shopping for insurance.

Are there discounts available with Erie auto insurance that can affect my overall quote?

Yes, Erie auto insurance offers various discounts that can significantly lower your overall quote. These discounts may include safe driver discounts, multi-policy discounts for bundling car and home insurance, and discounts for installing anti-theft devices in your vehicle. Additionally, completing a driver safety course may qualify you for further discounts. Checking for applicable discounts can enhance your savings.

How often should I update my Erie auto insurance quotes?

It’s advisable to update your Erie auto insurance quotes at least once a year or whenever you experience a significant life change, such as moving to a new location, getting married, or purchasing a new vehicle. Regularly reviewing your quotes ensures that you’re aware of any shifts in premiums based on market conditions or changes in your personal circumstances, allowing you to make adjustments as needed.

What should I do if I find a cheaper quote from another insurance provider?

If you find a cheaper quote from another insurance provider, you should first contact your Erie agent. Present the competing quote and inquire if they can match or offer a better rate. Sometimes, insurers are willing to negotiate to retain you as a customer. If they cannot offer a competitive rate, consider the benefits of switching providers, but also review the coverage details carefully to ensure you’re making a smart decision.

How can I assess my savings when comparing Erie Auto Insurance quotes?

To assess your savings with Erie Auto Insurance quotes, begin by gathering several quotes from different coverage options that meet your needs. Carefully review each quote, paying attention to the premiums, deductibles, and coverage limits. Additionally, consider any discounts you may be eligible for, such as those for safe driving, bundling policies, or having certain safety features in your vehicle. By comparing these factors, you can determine which quote offers the best value for your specific situation. It may also be beneficial to calculate the potential out-of-pocket costs in case of an accident to get a clearer picture of your overall savings.

What factors influence the auto insurance quotes I receive from Erie?

Several factors can influence the auto insurance quotes from Erie. Your driving history is significant; a clean record may result in lower rates, while accidents or traffic violations can increase your premiums. Additionally, the type of vehicle you drive plays a crucial role; more expensive or high-risk cars generally have higher insurance costs. Your location also matters, as areas with higher rates of accidents may lead to increased premiums. Furthermore, your age, credit score, and the amount of coverage you select can all impact the quotes you receive. Understanding these elements can help you make informed decisions about your policy and potential savings.

Reviews

Isabella

Have you ever assessed how much you could save by comparing quotes from Erie Auto Insurance? It seems like every time I check, I find something new and unexpected. Between discounts for good driving and bundling options, I’m curious – what surprises have you encountered while shopping around for auto insurance? Do you feel more empowered with the knowledge of different rates, or does the process just add to the confusion? And let’s be real, how often do we actually take the time to review our policies for better deals? Share your thoughts – are you a savvy shopper, or does it feel more like a chore?

Olivia

The focus on saving with Erie auto insurance quotes lacks depth. It superficially presents the numbers without addressing the nuances of actual coverage and real customer experiences. The emphasis should be on what these savings mean for protection on the road, rather than just percentages and comparisons.

David Brown

Is it just me, or does the process of comparing insurance quotes feel like trying to solve a Rubik’s Cube blindfolded? How exactly are we supposed to assess if we’re getting a good deal? I mean, one quote says I’m saving a fortune, while another one suggests I might as well have bought a unicorn. And are the people giving these quotes even real? I’m half expecting a talking cat to pop up with a better offer. If I wanted to play a guessing game, I’d just toss a coin. So, what’s the secret sauce to actually making sense of these numbers without losing my mind?

CrystalHeart

Why chase after savings like they’re holy grails? Updated quotes reveal not only costs but hidden motives driving insurance companies. Analyze the fine print, question the numbers, and remember—saving a few bucks can be an illusion in a system designed to profit from our uncertainty.

Richard Davis

How do you factor in changes in personal circumstances, like a new job or a recent move, when evaluating the potential savings with updated Erie Auto Insurance quotes? It seems like each tweak can lead to a completely different premium. Are there specific scenarios where you’ve noticed bigger shifts in savings, or do you find that a more consistent approach yields the best results? Also, what other elements do you think people often overlook that might impact their insurance costs significantly?